Payment Gateway Integration

for Your Ecommerce Website

Payment Gateway Integration

for Your Ecommerce Website

According to the latest research, ecommerce’s share of sales continues to steadily grow. This year, online sales represented around 15% growth in comparison to last year’s figures. Currently, online sales are forecasted to continue to grow up to 17% by 2022. Below, we reveal some secrets about something at the very heart of ecommerce. Payment gateways: how to choose the best one, and how to add a payment gateway to a website.

Table of Contents

ToggleA payment gateway is merely the software intended to deliver transactional data to the acquiring bank and retrieving responses from the issuing bank on whether a transaction was approved or declined. Essentially, payment gateways facilitate communication between banks.

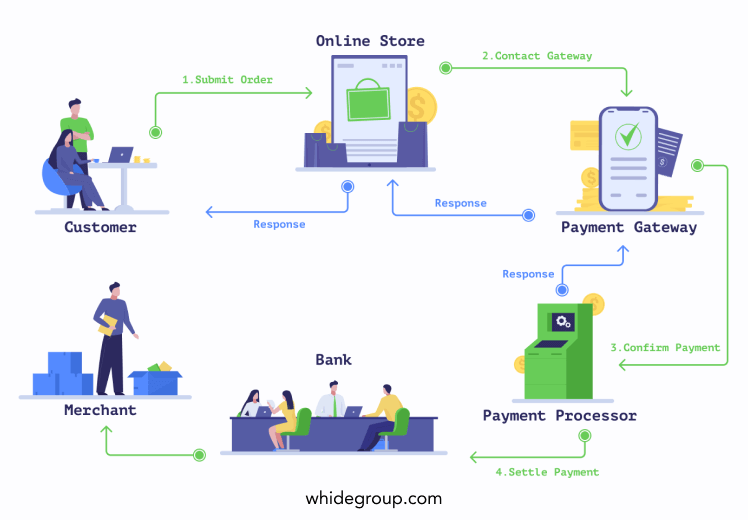

As for the working principles of a payment gateway – here’s what is going on right after a user clicks the “Order” button:

Every merchant falls under the PCI DSS, a government regulation standard containing a series of security requirements that every merchant must follow to be in compliance. However, the majority of ecommerce websites don’t store credit card data. Rather, they use third-party payment service providers like PayPal or Stripe to handle card information more securely. The merchants still need to be PCI DSS compliant, but the requirements aren’t as numerous compared to merchants who store credit card data.

After you’ve learned a few of the basics of payment gateways, namely the role of the payment gateway and how it works, you’re ready to proceed with learning the nuances of how to choose a reliable one.

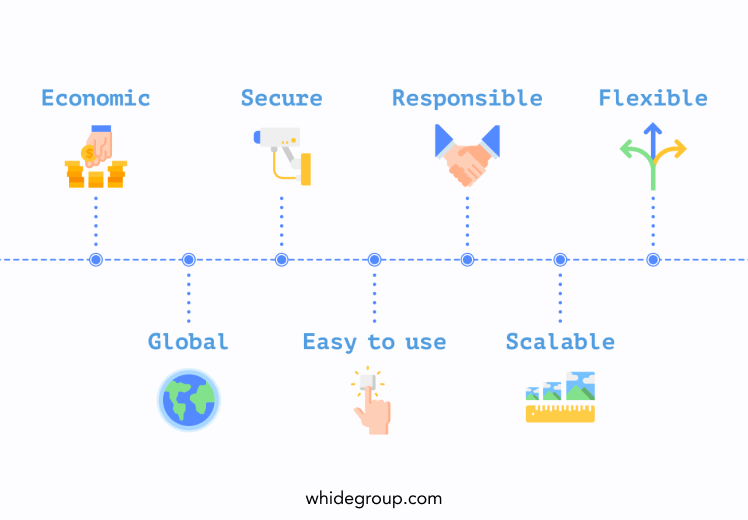

To maximize efficiency for your business, the payment gateway should meet some really basic requirements, such as usability and safety. In addition to these things, other means of enhancing your ecommerce website with payment gateway include making sure the gateway is:

Before you start to integrate a payment gateway in a website, it’s first necessary to decide which features you want to incorporate with the gateway. We’ve prepared a list of the features that are in the most demand:

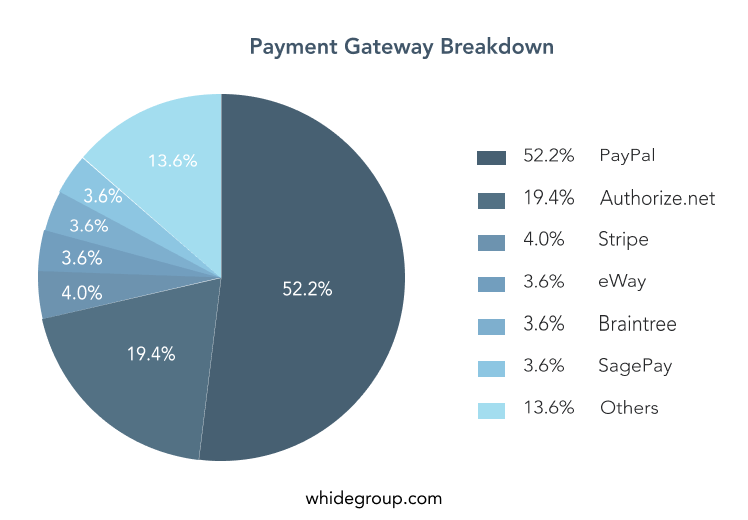

Before you review the payment gateways themselves, let’s take a short look at some stats about which payment gateways are the most widely used.

Since you’ve got some guidelines above on how to choose a payment gateway, we can take a look at the top payment gateways that was in use by ecommerce stores worldwide in 2021.

Let’s start reviewing them in detail!

The list of the most popular payment gateways can only be opened by PayPal. How PayPal works and what conditions it offers, made this payment system well-known and very popular. It currently serves around 350k websites and 184 million customer accounts. Equally advantageous for both small businesses and market leaders, PayPal doesn’t require any setup or monthly fees. Currently, PayPal is considered as the most reputable and the most international payment gateway, available on over 200 markets and accepting 26 leading currencies. In its commitment to security, PayPal adheres to all leading encryption standards, keeping payment credentials guarded.

Highlights:

Coinbase is considered to be the most user-friendly payment gateway for cryptocurrency, with the added bonus of an exceptionally convenient mobile interface. To date, it supports over 40 cryptocurrencies and they’re not going to stop there! For you, this means no limitations on yourself or your customers in terms of what cryptocurrency to choose for payments.

Highlights:

Another popular option to consider if you want to make a website with a payment gateway is Stripe. Created by industry experts, Stripe is an extremely developer-centric payment software. This means you’ll be able to build production-ready integrations using any modern tools – from React components to real-time webhooks. If you opt for the Stripe payment platform, you also choose less long-term maintenance and more concentration on customer and product experience. Stripe processes charges and displays prices in the customer’s preferred currency, which improves sales and helps customers avoid conversion costs.

Highlights:

Despite only being on the market for 16 years, 2Checkout is available in 196 countries, serves over 50k merchants, works with 87 different currencies and offers 15 languages to choose from. Customers enjoy this fully-featured payment solution for its robustness and low-cost fee structure. Another advantage is that you don’t have to pay any monthly or setup fees!

Highlights:

Another great option to take into account while considering how to create a website with payment gateway is Authorize.net. Currently, Authorize.net is one of the most sought-after payment gateways, as proven by the more than 400k merchants that use it worldwide. This platform is extremely well documented and has a range of tutorials and other training materials to give users confidence while managing it. You’ll also appreciate the 24/7 free support provided by professionals who will assist you in solving any possible issue you may have.

Highlights:

Designed to be convenient for both businesses and individuals, Skrill is another good option to implement a payment gateway. This service is a preferable option to the many pricier platforms and gateways available because it allows you to create an account for free and charges only 1% of the transaction’s value on the sender’s side. Skrill is also easy to link to any bank account worldwide and takes excellent care of the security of your payment information.

Highlights:

Depending on the ecommerce platform you use to run your online business, you can use a wide variety of off-the-shelf plugins and extensions offered by your platform. They will enable you to integrate your store with every payment gateway mentioned in this article.

Website integration with a payment gateway starts with registering a bank account, which will then be attached to the gateway. Make sure your registered bank account is authorized to accept funds, since regular bank accounts may not work for this. Right after the approval of your merchant account, it’s time to choose your gateway.

After you have selected your gateway, you’ll follow a specific setup procedure in order to add it to your store. Depending on the payment gateway you’ve chosen, it can be pretty simple via plugin or add-on, or it may require some custom development. Right after website integration with the payment gateway, we recommend that you turn to a QA engineer to ensure the gateway works properly. You should also check the PCI DSS compliance to be 100% sure the gateway is fully secure and doesn’t display credit card information.

Finally, after the payment gateway integration process is completed successfully, you are fully ready to use it, accept payments from customers, and mark their orders as ready to fulfill on your end.

After you’ve reviewed the most popular existing solutions for payments in the world of ecommerce, you may instead wonder about developing your own payment gateway for your ecommerce site. And, judiciously, you’d like to learn more details about the process.

Custom payment gateway development is a pretty complex, not to mention pricey, process. In general, if we look at full-stack payment gateway development, it takes from $100,000, and that just the price for development. This is just the price for development since there are so many facets to cover. And each of these aspects means an additional item of expenditure for you! Let’s look at some of the necessary steps:

And the most crucial one – obtain PCI certifications. On average, this step will cost you about $15,000.

So, as you can see, in addition to the complexity of the development itself, custom payment gateway development in general is not a piece of cake. With this in mind, we’d recommend you to consider the already existing solutions and build your own system on top of it.

Although we recommend using an already-established payment gateway, sometimes already-established programs just don’t tick all the right boxes. In the event that you haven’t found a suitable payment solution, you can consider the option to develop your own, as Savvy.io, one of our recent customers, did. For Savvy.io, we developed a cryptocurrency wallet for supporting, receiving, keeping and exchanging cryptocurrency.

This client came to us with a query on developing a payment gateway extension based on Savvy API. He had the following requirements for the extension. It had to:

The first thing we did was a thorough analysis of every above-mentioned ecommerce platform. After learning all their features and peculiarities, we were able to create the best approach to develop modules for each. As a result, we developed a secure and reliable solution that successfully scales along with further Savvy API development. You can learn more details about the Savvy.io development process by reading the case study.

Your choice of payment gateway and how that gateway and its options are presented on your store will have a significant influence on the user experience of your customers. Choose well, and you’ll have more customers. Choose poorly, and you can easily guess the consequences.

We hope you now have a clear impression of the procedure of payment gateway integration for ecommerce step-by-step. However, if you still have questions about anything, or would like to discuss your project with an industry professional, don’t hesitate to drop us a line – we are here to help!

Share This Article

Ecommerce Analytics Tools: Product Owner’s Guide for 2023

Ecommerce Analytics Tools: Product Owner’s Guide for 2023

It’s an informative article and helpful also. You have given a perfect guideline for payment gateway integration. I am appreciating you for this article.

Thanks for sharing.

Hi there everybody, here every one is sharing such know-how, so it’s fastidious to read this web site, and I used to pay a visit this webpage daily.